Table of Content

- Why 2026 Is Different for Travel API Integration

- Flight APIs

- Hotel APIs

- Tours and Activities

- Payment and Fraud APIs: High-Risk MCC Reality

- API Integration by Product Type

- Real Integration Challenges

- AI's Actual Role in Travel API Integration

- Direct APIs vs Aggregators

Let’s start Travel API integration?

Book a callFive years ago, you could build a travel product by connecting to Amadeus or Sabre, waiting a few months for certification, and calling it done. Today? Airlines push direct booking channels. Everyone’s using AI to rerank results. And yet the same question was asked: which APIs do we need, and how do we integrate them without the whole thing taking a year?

This isn’t a guide that’ll tell you why Amadeus exists or what an API technically is. You already know that. This is about API integration specifics, market realities, and the stuff that makes or breaks your product when you’re six months into connecting to your third GDS and discovering that sandbox behavior bears little resemblance to production.

Why 2026 Is Different for Travel API Integration

Three shifts define the current state of travel API integration:

NDC has moved from “future” to “present.” Many airlines now use NDC to, at least, some degree. American Airlines reports 80% of bookings through NDC or direct channels. Lufthansa pioneered GDS surcharges. This isn’t gradual adoption anymore – it’s become a market infrastructure. If you’re building flight search or booking, you’re dealing with NDC 21.3 schemas, dynamic pricing that changes by the minute, and fare structures that don’t map cleanly to the old EDIFACT world.

Direct booking pressure is also reshaping hotel distribution. Properties want to reduce OTA commissions. Channel managers like SiteMinder and Cloudbeds have become critical middleware. But integrating with a PMS or channel manager API means navigating two-way syncs, room mapping complexity, and availability delays that can ghost-book or double-book your users if you’re not careful.

AI changed discovery (not to mention not always accurate), not distribution. Generative AI tools analyze docs faster and generate boilerplate code, but they don’t solve tariff logic or business rules buried three layers deep in an airline’s NDC implementation. Founders who expected AI to auto-integrate APIs learned this the hard way.

The market is more accessible than ever – there are aggregators, SDKs, and sandbox environments. But complexity hasn’t decreased. It’s shifted.

Flight APIs: GDS, NDC, and the Shift You Can’t Ignore

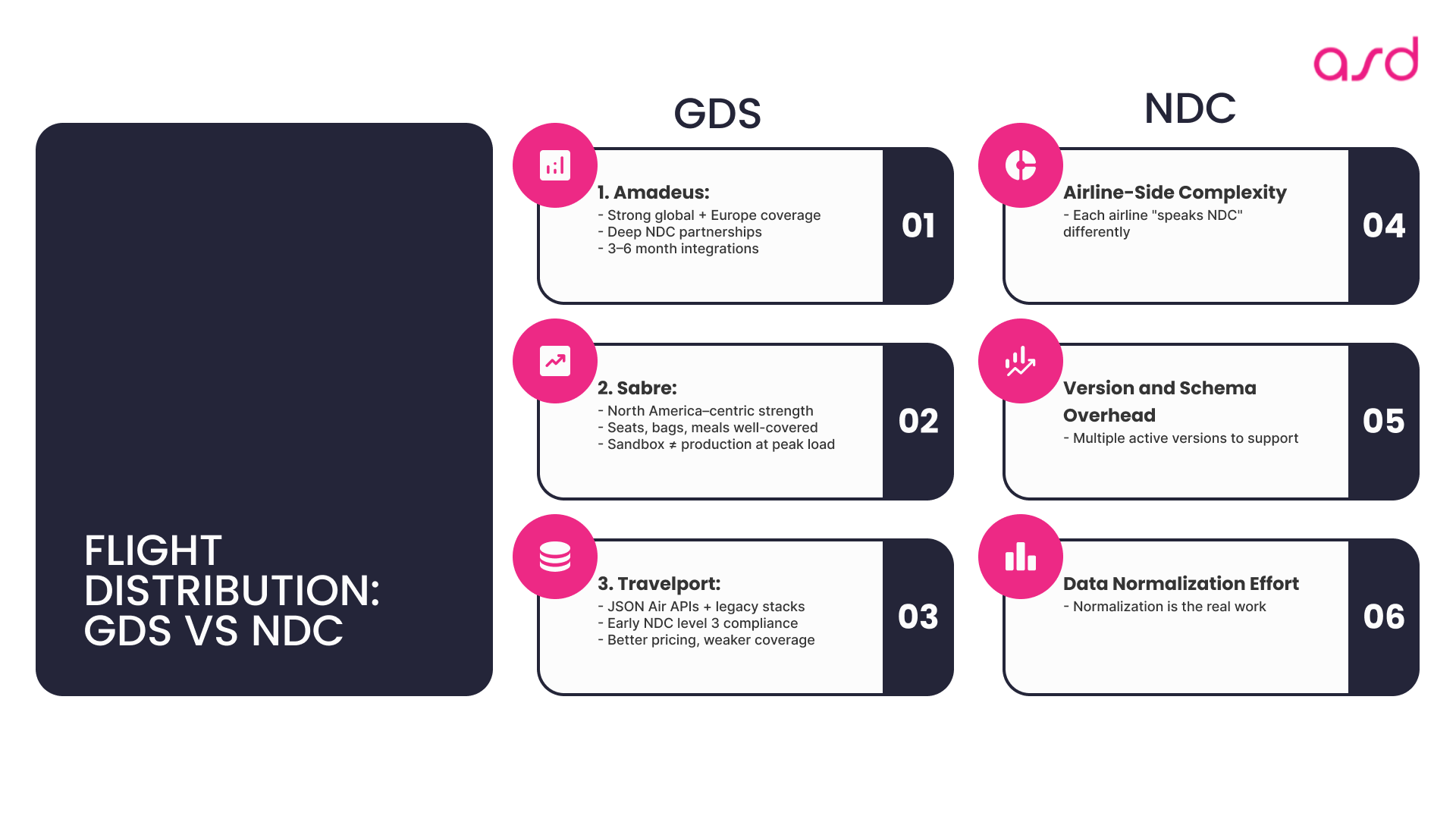

GDS: Amadeus, Sabre, Travelport

The three major players – Amadeus, Sabre, Travelport – still control roughly 65% of the global flight distribution market. They aggregate inventory from 400+ airlines, provide XML or JSON APIs, and offer relatively stable (if expensive) access to global content.

Amadeus leads in European and global coverage with strong NDC partnerships across 35 airlines. Their APIs use XML-based SOAP for traditional content and support continuous pricing models that adjust fares dynamically. Developer support is robust, but integration timelines often stretch to 3-6 months for full implementations.

Sabre dominates in North America and offers extensive ancillary support (seat selection, baggage, meals). Sabre Dev Studio provides SDKs and sandbox access. Their ARM index certification shows strong NDC maturity, though some developers report that production behavior differs noticeably from sandbox during peak load.

Travelport combines Apollo, Galileo, and Worldspan into a hybrid model with JSON Air APIs. They were first to achieve NDC level 3 compliance. Pricing tends to be more accessible for smaller agencies, but airline coverage lags slightly behind Amadeus and Sabre in emerging markets.

NDC: The Reality in 2026

New Distribution Capability is no longer optional. Airlines use NDC to push branded fares, dynamic pricing, and ancillaries directly. As a result, each airline implements NDC differently. Version fragmentation (17.2, 18.1, 21.3, 24.1) creates compatibility headaches. Business rules – like which fares are available through which channels – aren’t always documented (and rarely documented properly).

Integrating NDC means:

- Handling multiple schema versions

- Parsing dynamic offers that don’t have fixed price points

- Managing post-booking servicing that varies by airline

- Accepting that some content is NDC-exclusive

A metasearch startup we know connected to five NDC providers and spent two months just normalizing fare structures into a consistent format for their UI. That’s not an edge case – it’s baseline effort for NDC integration.

We provide end-to-end API Integration services, helping you connect bookings, payments, and other third-party APIs seamlessly.

Hotel APIs: From Channel Managers to Wholesale Aggregators

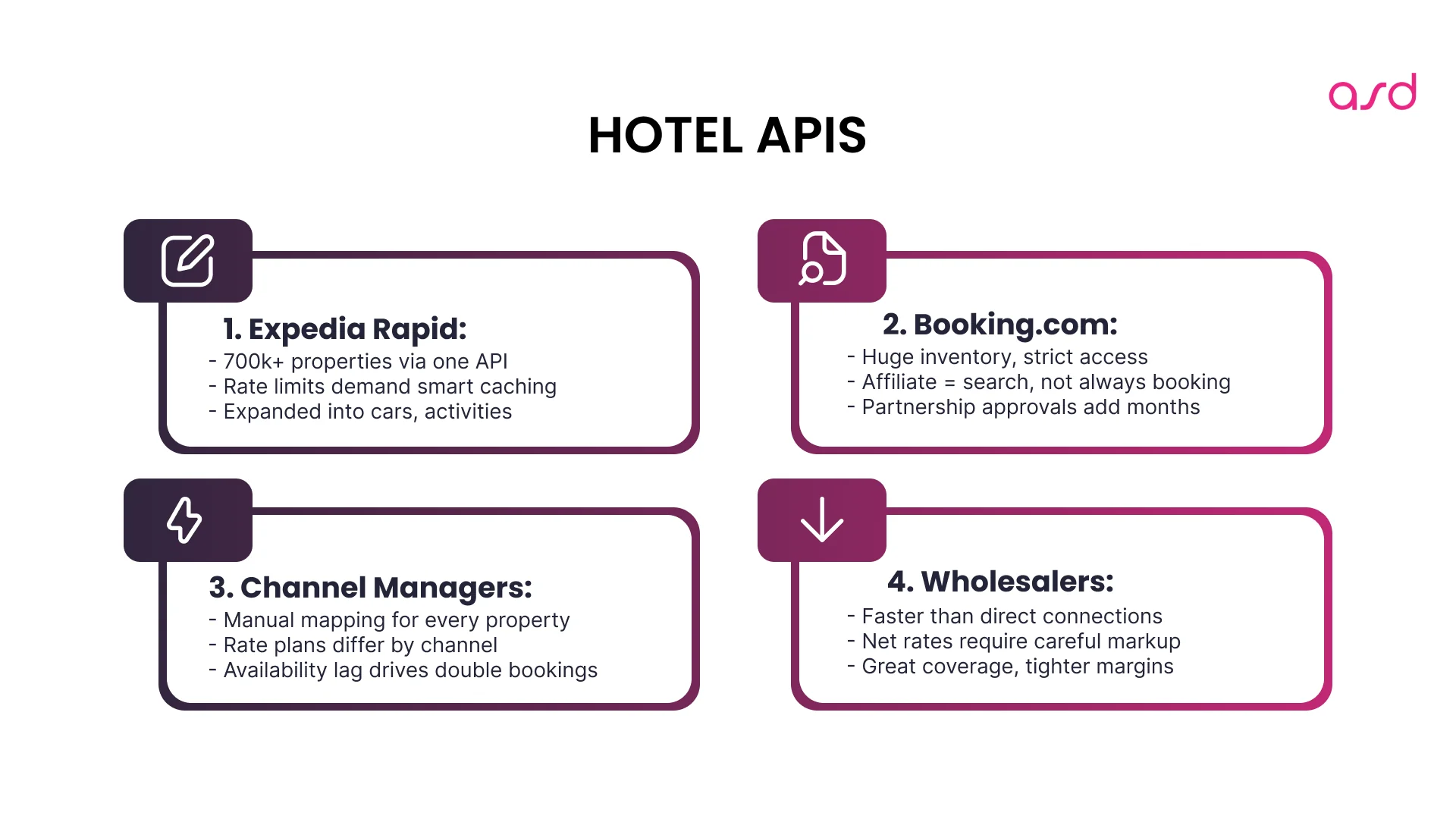

Expedia Rapid API and OTA Giants

Expedia Rapid API provides access to 700,000+ properties globally, which have their own API integration best practices. The appeal: competitive rates, direct content sourcing, and faster integration compared to building individual connections to hotel chains. In May 2025, Expedia launched new APIs for cars, activities, and insurance, positioning Rapid as an end-to-end B2B platform.

Rate limits matter here. Expedia enforces request throttling, and hitting limits during peak booking periods (holiday weekends, major events) can block your search flow. Caching strategies and asynchronous availability checks become non-negotiable.

Booking.com remains one of the largest inventories, but access is tightly controlled. Connecting via their Affiliate API gives search and display capabilities, but actual booking requires partnership agreements that can take months to establish.

Channel Managers and PMS Integrations

This is where things get messy. Property management systems don’t expose APIs uniformly. Integrating with a channel manager like SiteMinder, Cloudbeds, or Hostaway means:

- Room mapping: A “Deluxe Ocean View” on your platform might be “Room Type 3B” in the PMS. Manual mapping, every property, every time.

- Rate plans: Different channels offer different rates. Parsing which rate applies to which booking channel requires understanding the property’s entire distribution strategy.

- Availability lag: Updates aren’t always real-time. A room sold on Airbnb might take 30-90 seconds to reflect in the PMS, creating race conditions for double bookings.

One client built a property management software solution and discovered that their PMS partner updated availability every 60 seconds in the sandbox but every 5 minutes in production during peak load. The result? Overbooked rooms and support chaos.

Wholesalers: Hotelbeds, Tourico

Wholesalers aggregate hotel content and offer net rates (prices without commissions baked in). Hotelbeds connects to 180,000+ properties. Integration is faster than building direct connections, but you’re trading margin for speed. Markup strategies become critical.

Tours, Activities, and the APIs Nobody Talks About

Viator, GetYourGuide, Klook

Tours and activities APIs are the wild west of travel integration. Products vary wildly – skip-the-line tickets, multi-day tours, cooking classes, and helicopter rides. Each has unique attributes: group size, age restrictions, cancellation policies, and meeting points.

Viator (owned by TripAdvisor) provides API access to thousands of activities globally. The challenge: data structure inconsistency. One tour might have 15 options (different times, group sizes), while another is fixed-departure only.

GetYourGuide and Klook operate similarly but with different geographic strengths (Europe vs Asia). Rate limits are aggressive – Viator, for example, throttles search heavily during peak seasons.

Real scenario: A marketplace integrated GetYourGuide and found that 20% of products had incomplete descriptions in English, requiring manual content curation before going live.

Car Rentals

Car rental APIs are surprisingly limited. Major players (Hertz, Enterprise, Avis) don’t offer public APIs. Most integrations happen through aggregators like Cartrawler or Rentalcars.com. Availability logic is location-based, and fleet structures (compact, SUV, luxury) don’t map consistently across providers.

Get Your Free API Integration Consultation

Payment and Fraud APIs: High-Risk MCC Reality

Travel is classified as a high-risk MCC (Merchant Category Code) by payment processors. Chargebacks happen frequently – canceled trips, no-shows, disputes over services. This affects which payment APIs you can use and how much you’ll pay.

Payment Processing

Stripe supports travel businesses but applies stricter rules: rolling reserves (holding a percentage of transactions), delayed payouts, and enhanced KYC requirements. Connect accounts for marketplace models add complexity – you’re responsible for onboarding sub-merchants (hotels, tour operators) who meet Stripe’s standards.

Braintree (PayPal) offers similar functionality but with higher fees for travel MCC. Adyen is popular with larger OTAs due to its support for 100+ currencies and local payment methods, but setup requires a significant technical lift.

Fraud and Risk Scoring

3DS (3D Secure 2.0) is now effectively mandatory in Europe and increasingly in other markets. Friction vs security is the tradeoff. Forcing 3DS on every transaction reduces fraud but kills conversion rates.

Risk scoring tools like Sift or Riskified analyze transaction patterns to flag suspicious behavior. Integrating these adds latency to checkout flow – expect 200-500ms per transaction. For high-volume products, that latency compounds.

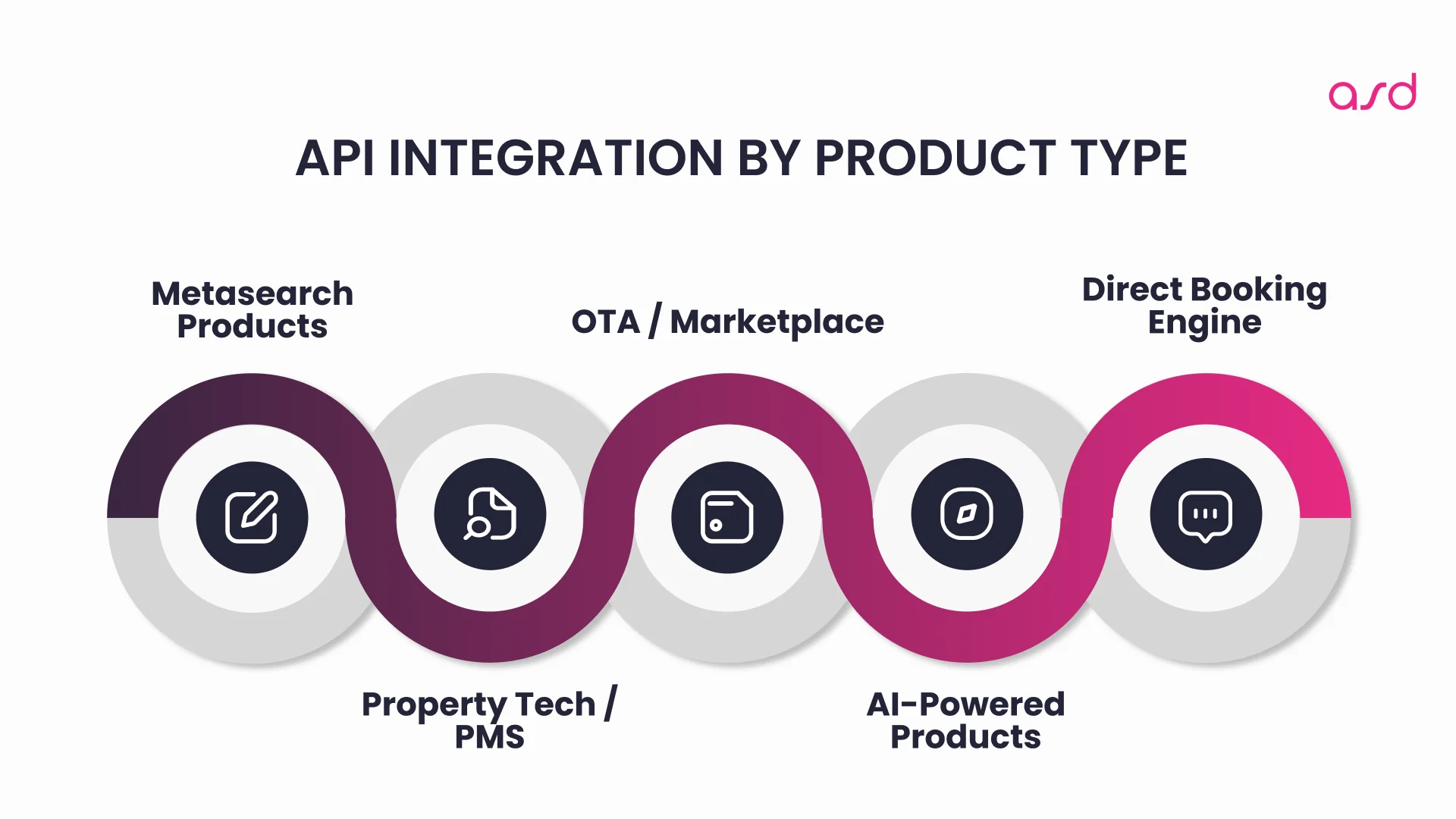

API Integration by Product Type

Different products need different API stacks. Here’s what actually matters:

Metasearch Products

You’re aggregating flight, hotel, or activity options from multiple sources. Speed is everything. Users expect results in under 2 seconds.

Key APIs:

- Multiple flight aggregators (Amadeus, Skyscanner API, Kiwi.com)

- Hotel metasearch (Trivago, Kayak, direct API partnerships)

- Caching layers (Redis, Memcached) to store frequent searches

- CDN for static content

Challenges:

- Rate limits across 5-10 providers simultaneously

- Normalizing data formats (price display, layover details, amenities)

- Managing affiliate tracking across multiple OTAs

OTA / Marketplace

You’re facilitating actual bookings. Reliability trumps speed. A failed booking costs trust and revenue. Travel portal software development at this level requires rock-solid infrastructure.

Key APIs:

- Booking-enabled flight APIs (GDS or NDC)

- Hotel channel manager integrations

- Payment APIs with fraud detection

- Booking confirmation and ticket generation

Challenges:

- Error handling when a booking fails mid-transaction

- Partial booking states (flight confirmed, hotel pending)

- Refund and cancellation flows that vary by provider

Direct Booking Engine

You’re powering bookings for a single brand – hotel chain, tour operator, or airline.

Key APIs:

- PMS integration (two-way sync)

- Payment processing

- Loyalty program APIs

- CRM for guest data

Challenges:

- Real-time availability without lag

- Handling high concurrency during flash sales

- Mobile optimization for direct booking flows

Property Tech / PMS

You’re building the system that hotels use internally. Integrations go both ways – receiving bookings from OTAs, sending availability updates out.

Key APIs:

- Channel manager connections (SiteMinder, Cloudbeds)

- Payment gateways

- Housekeeping and staff management tools

- Reporting and analytics APIs

Challenges:

- Complex data models (rooms, rate plans, restrictions)

- Managing state across multiple distribution channels

- Handling booking modifications and cancellations in real-time

AI-Powered Travel Products

You’re using AI for personalization, dynamic reranking, or conversational interfaces.

Key APIs:

- Travel APIs for content (as above)

- LLM APIs (OpenAI, Anthropic) for natural language

- Vector databases for semantic search (Pinecone, Weaviate)

- User behavior tracking for personalization

Reality check: AI doesn’t replace integration work. It complements it. You still need clean, structured data from travel APIs to feed your models. AI can rerank search results based on user preferences, but it can’t magically fix a poorly documented API or handle availability race conditions.

Real Integration Challenges (The Ones That Actually Happen)

Let’s skip the polished case studies and talk about what actually breaks:

Rate Limits and Throttling

Every provider enforces limits – 100 requests/minute, 1,000 requests/hour, whatever. The problem: those limits hit differently in production than in testing.

During Thanksgiving week, a flight search startup saw its Amadeus API requests throttled at 60% of their contractual limit. Why? Shared infrastructure. Your quota isn’t isolated – it’s affected by total platform load.

Solution: Implement exponential backoff, request queuing, and aggressive caching. Accept that peak periods will degrade performance.

Sandbox vs Production Differences

Sandbox environments lie. They return perfect data, simulate instant responses, and rarely fail. Production is messier:

- Slower response times (300ms in sandbox, 2 seconds in production)

- Incomplete data (missing amenities, images, descriptions)

- Inconsistent error codes

- Rate limits are enforced differently

A hotel booking platform was tested successfully in a sandbox for months. First week in production: timeout errors on 15% of searches because production servers were geographically distributed and latency varied by region.

Availability Race Conditions

Two users search for the same room at the same time. Both see availability. Both try to book. One succeeds, and one gets an error after entering payment details. Frustrating for users, costly for you (support tickets, refunds, reputation damage).

Mitigation: Hold inventory during the booking process (if the API supports it), implement optimistic locking, and show clear warnings about availability being subject to change.

Business Rules Nobody Documents

Airlines, hotels, and tour operators have internal rules that don’t appear in API documentation:

- Fare classes are only bookable through certain channels

- Blackout dates for promotional rates

- Minimum advance purchase requirements

- Restrictions on combining certain ancillaries

You discover these through trial, error, and support tickets. Budget time for it.

Data Format Chaos

Even within a single API, response formats can vary:

- One hotel returns 20 images, another returns 2

- Flight durations might be in minutes or ISO 8601 format

- Price breakdowns: sometimes inclusive of taxes, sometimes not

- Amenities as structured data vs free text

Normalizing this into a consistent UI requires significant data transformation logic.

Documentation Dependencies

Travel API documentation ranges from excellent to essentially non-existent. You’re often dependent on:

- Documentation quality: Some providers offer interactive API explorers, detailed examples, and clear versioning. Others give you a PDF from 2019 and a “contact support” email.

- Version fragmentation: NDC alone has seven major versions in active use. Your integration might work perfectly with v21.3, but a partner airline only supports v18.1. Now you’re maintaining multiple parsers.

- Undocumented changes: API providers push updates without warning. A field that returned a string yesterday returns an array today. Your production system breaks at 3 AM.

- Language barriers: Some regional providers document exclusively in their local language. Machine translation helps, but technical nuances get lost.

- Time Dependencies and Scope Creep

Integration timelines expand based on factors you can’t control:

- Certification delays: GDS providers require testing and approval before production access. This can add 6-8 weeks even after your code is ready. You’re waiting on their schedule, not yours.

- Provider responsiveness: Support ticket response times vary dramatically. Amadeus might respond in hours. A smaller regional provider might take weeks.

- Seasonal availability: Some providers only offer onboarding during specific periods. Miss the window, wait another quarter.

- Contractual negotiations: Before you write a single line of code, legal and commercial teams need to finalize agreements. This can take 2-6 months for enterprise providers.

- Previous Team Dependencies

Inheriting travel API integrations from another team creates unique challenges:

- Tribal knowledge loss: The developer who built the original integration left. Comments are sparse. Why does this caching layer exist? Nobody knows.

- Legacy workarounds: You find code that adds a 500ms delay before every booking call. Turns out it’s handling a race condition from 2022 that might not exist anymore. Do you remove it and risk breaking production?

- Undocumented customizations: The previous team built custom logic for specific edge cases. A hotel chain required special rate calculations. An airline needed unique baggage handling. None of this is documented.

- Technical debt accumulation: Integrations built under time pressure often carry compromises – hardcoded values, missing error handling, incomplete data validation. You inherit all of it.

- Version lock-in: The system uses an older API version because upgrading requires retesting everything. But that version loses support in six months. Now you’re forced to upgrade on someone else’s timeline.

One founder told us: “We acquired a travel startup with ‘working integrations’ to eight hotel APIs. Turned out three were broken, but nobody noticed because traffic was low. Two used deprecated endpoints. One was hardcoded to always return the same test property. We spent four months just understanding what we actually had.”

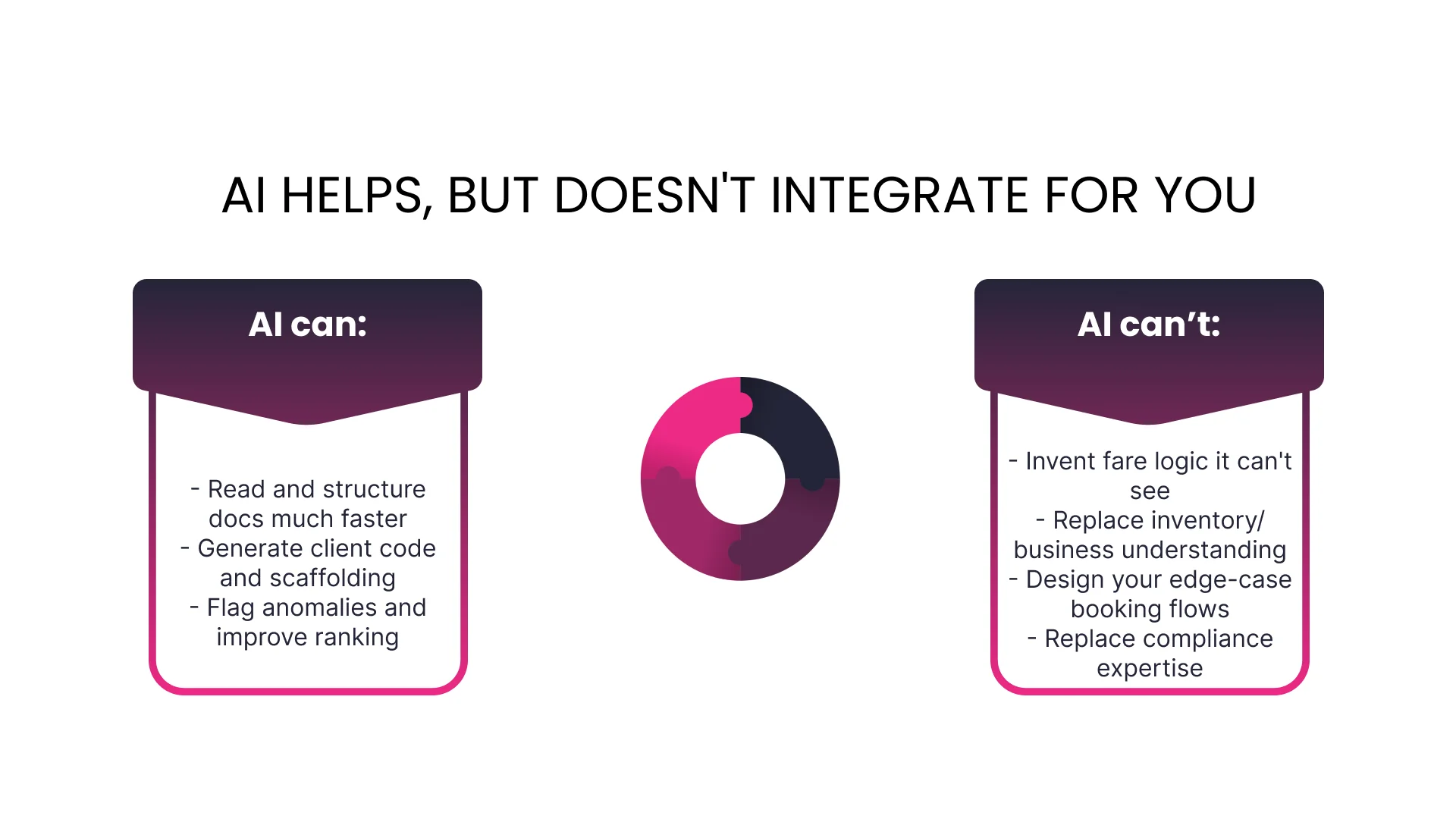

AI’s Actual Role in Travel API Integration

AI tools accelerate parts of the integration process. They don’t replace it.

What AI Actually Helps With

- Documentation analysis: Claude, GPT-4, and similar models can parse API documentation quickly, extract endpoint details, and generate initial integration code. Useful for getting started.

- Boilerplate generation: Writing API client libraries, request/response models, and error handling scaffolding is repetitive. AI generates this faster than manual coding.

- Anomaly detection: ML models can flag unusual API behavior – response time spikes, error rate increases, unexpected data structures. Helpful for monitoring production systems.

- Search reranking: AI excels at personalizing search results. If you have user behavior data, models can rerank flight or hotel options to surface better matches. This improves conversion without changing the underlying API.

What AI Doesn’t Fix

- Tariff logic: Airline pricing rules are complex – fare families, fare basis codes, penalties, restrictions. AI can’t auto-generate logic for something it doesn’t have training data on.

- Availability state management: Handling inventory across multiple channels requires understanding business rules. AI doesn’t replace domain expertise.

- Booking flow edge cases: What happens when a payment succeeds but the booking API times out? AI won’t design that flow for you.

- Compliance and fraud: Payment regulations, GDPR, PCI compliance – these require legal and technical knowledge that AI can assist with, not replace.

One founder told us, “We used AI to write 60% of our API integration code in a week. Then we spent three months debugging why production bookings failed intermittently. AI gave us speed, not reliability.”

Add API to your Platform We help TravelTech founders integrate complex APIs and launch faster. Schedule a consultation.

Direct APIs vs Aggregators: What You’re Trading

Direct APIs (Amadeus, Sabre, Travelport, Airline NDC)

Pros:

- Access to full content – sometimes exclusive fares and ancillaries

- Better pricing control (you negotiate rates)

- Direct relationship with the provider

Cons:

- Longer integration time (3-6 months per GDS)

- Higher technical complexity (each provider has a unique structure)

- Certification requirements (testing, approval processes)

- More expensive (volume commitments, setup fees)

Aggregators (Kiwi.com, Skyscanner API, Duffel)

Pros:

- Faster integration (single API, multiple sources)

- Unified data format (less normalization work)

- Lower upfront cost (pay-per-booking models)

- Easier to test and launch

Cons:

- Less content control (you get what the aggregator includes)

- Margin pressure (aggregator takes a cut)

- Dependency risk (aggregator’s uptime affects you)

- Potentially less competitive pricing

The decision isn’t either/or for larger products. Many TravelTech companies use aggregators for MVP launch, then add direct APIs as they scale.

Questions? Answers!

Which travel APIs should I integrate for my product?

- For a flight metasearch, start with a single aggregator like Kiwi.com or Duffel to validate demand, then add GDS access if you need better content.

- For a hotel booking engine, connect to an OTA API (Expedia Rapid) or channel manager if you’re targeting properties directly.

- For a comprehensive travel platform, expect to integrate 5-10 APIs minimum – flights, hotels, activities, payments, fraud detection.

Why do API integrations take so long?

Because they’re not just technical – they’re operational. The technical work (writing code to call an API) is 30-40% of the effort. The rest is:

- Understanding business rules specific to that provider

- Normalizing data into your product’s format

- Handling error cases that only appear in production

- Testing across different scenarios (peak load, edge cases, concurrent bookings)

- Certification and approval processes (for GDS integrations, this can add 4-8 weeks)

Read more about how long API integration actually takes for travel products.

How do I know if an API provider is stable and scalable?

Ask these questions:

- What’s their documented uptime? (Look for 99.9%+)

- Do they offer SLA guarantees?

- How do rate limits scale with your usage?

- What’s the support response time for production issues?

- Can you talk to other companies using their API?

Check their status page. Providers with public status pages (e.g., status.amadeus.com) show transparency. If they’re hiding uptime data, that’s a red flag.

Test in production early. Sandbox performance doesn’t predict production reliability. Get to production as fast as possible, even with limited traffic, to validate real-world behavior.

What’s the real cost of travel API integration?

It’s not just API fees. A single major integration typically costs $5,000–$15,000+ for initial development, depending on complexity. Budget for:

- Development time: 2-6 months per major integration (GDS, PMS, channel manager). A basic OTA API might run $5,000–$7,000, while full GDS certification with NDC can exceed $15,000–$25,000.

- API usage costs: Volume-based (Amadeus charges per search or booking), subscription models (fixed monthly fee), or rev-share (percentage of bookings).

- Infrastructure: Caching, CDN, monitoring tools add $500–$2,000+ monthly depending on scale.

- Support: Handling API changes and debugging production issues requires ongoing engineering time.

- Compliance: PCI DSS for payments, GDPR for user data can add $3,000–$10,000+ depending on your existing setup.

- Small teams often underestimate operational costs—maintaining integrations requires ongoing engineering time. Budget 20-30% of your initial development cost annually for maintenance. A $10,000 integration means $2,000–$3,000/year in upkeep.

Price drivers: Integration complexity, number of endpoints, team rates, timeline pressure, testing requirements, and volume of concurrent integrations.