Table of Content

- Introduction to Travel Payment Integration

- Why Payment Processing Matters in Travel Tech

- Benefits of Travel Payment Integration

- How Travel Industry Payments Work

- Handling Cancellations, Refunds, and Chargebacks

- Security and Compliance (What You Actually Need to Know)

- Optimizing the Payment Experience for More Conversions

- Streamlining Travel Payments

- International Payments & Multi-Currency Handling

- Best Payment Gateway for Travel Startups

- How to Pick the Right Payment Provider for your Business?

- One-Stop Shop for Travel Payments

- Paying Suppliers and Vendors

- What’s Next? Future Trends in Travel Payments

- How to Integrate a Payment Gateway into Your Travel Platform

- Summary

Get a Payment Integration Advise

Book a callHave you ever lost a booking because of a failed payment at checkouts? Or dealt with refund disputes that ate into your profits? Travel payment processing is far more complex than traditional e-commerce—customers book in advance, expect instant confirmations, and often pay in multiple currencies.

This is why travel payment integration is essential for businesses aiming to streamline transactions and boost customer satisfaction. Payment processing for the travel industry is critical to overcoming these challenges, ensuring smooth operations, and maximizing revenue. In this guide, we’ll explore how to integrate payment systems effectively and choose the best providers to meet your business needs.

Key Takeaways

- Efficient payment processing for the travel industry is essential for travel businesses, directly impacting conversion rates and customer satisfaction.

- Selecting the right payment provider for travel involves considering fees, fraud prevention, and multi-currency support to enhance profitability and security.

- Clear refund policies and effective management of cancellations can improve customer experience and loyalty, while compliance with security standards is crucial for protecting financial data.

Introduction to Travel Payment Integration

Travel payment integration is a crucial aspect of the travel industry, enabling online travel agencies (OTAs) and travel businesses to manage their payment processes efficiently. With the rise of digital payments, travel companies need to adapt to the changing landscape and provide secure, reliable, and convenient payment options to their customers. A well-integrated payment system can help travel businesses streamline their payment processes, reduce costs, and improve their overall customer experience.

In today’s competitive market, having a robust payment integration is not just a luxury but a necessity. It allows travel businesses to offer a seamless booking experience, handle multiple currencies, and ensure that transactions are processed quickly and securely. By integrating advanced payment solutions, travel companies can cater to the diverse needs of their customers, whether they are booking flights, hotels, or tours. This integration also helps in managing refunds, cancellations, and chargebacks more effectively, ensuring that the entire process is smooth and hassle-free for both the business and its customers.

Why Payment Processing Matters in Travel Tech

A smooth and efficient payment process is the backbone of any successful travel business. When customers can easily complete their bookings, it leads to increased conversions and higher revenue. However, many travel platforms struggle with poor payment flows, including bank transfers, which can lead to significant losses.

Challenges associated with credit card payments, such as chargebacks and disputes, and debit transactions, including direct bank payments, are significant in the travel industry, affecting both security and cost-effectiveness.

When it comes to implementing payment solutions, travel businesses must decide between API connections and full integrations. APIs provide quick implementation with standardized endpoints but may lack customization options for travel-specific needs. Full integrations, while requiring more development time upfront, offer deeper functionality tailored to travel payment complexities like multi-currency transactions, deposit handling, and refund policies.

Common issues faced by travel platforms include travel industry payment gateway solutions, and their failures, slow processing times, and lack of support for multiple payment methods. These issues not only frustrate customers but also result in abandoned bookings.

Efficient payment processing keeps your customers happy and maintains steady cash flow through direct bank payments and online payments.

Benefits of Travel Payment Integration

The benefits of travel payment integration are numerous. By integrating payment processes, travel businesses can simplify their payment systems, reduce the risk of errors and fraud, and improve their cash flow. Additionally, travel payment integration can provide a competitive edge, enabling businesses to stay ahead of the competition and offer a seamless payment experience to their customers. With the ability to manage multiple currencies, payment methods, and supplier payments, travel businesses can focus on growing their business and improving their revenue.

A well-integrated payment system also enhances operational efficiency by automating routine tasks and reducing manual intervention. This not only saves time but also minimizes the chances of human error, leading to more accurate financial operations. Moreover, by offering a variety of payment options, travel businesses can cater to a broader audience, including international customers, thereby expanding their market reach. The ability to handle multiple currencies and local payment methods ensures that customers from different regions can make payments conveniently, further boosting conversion rates and customer satisfaction.

How Travel Industry Payments Work

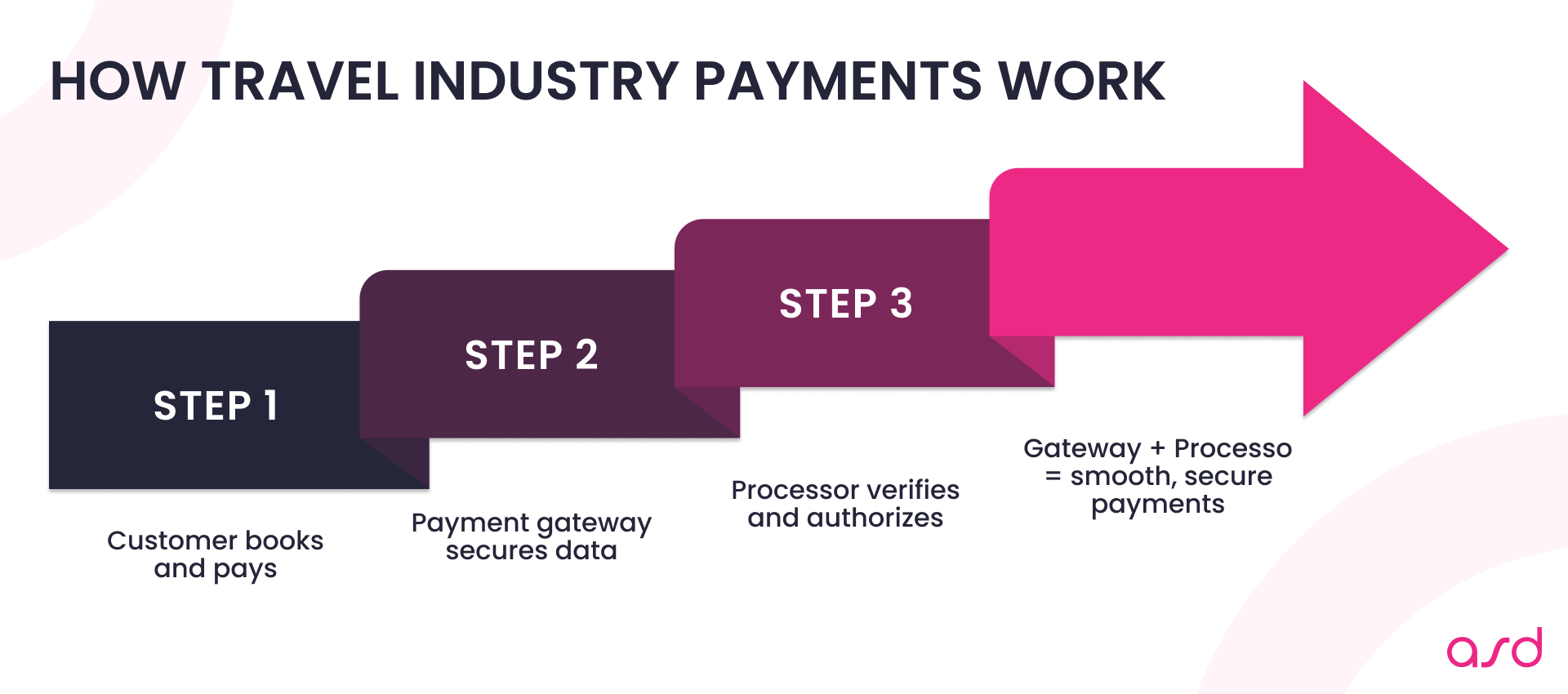

When a customer books a trip and makes a payment, a series of processes are set into motion. First, the booking and payment process details are sent through a payment gateway for the travel industry, which securely transmits the information to a payment processor. The processor then verifies the payment details and authorizes the transaction.

Transaction data is crucial in ensuring secure and efficient payments, as it helps in combating payment fraud and chargebacks.

Knowing the roles of payment gateways and processors is vital. A payment gateway transfers payment information, whereas a payment processor handles the transaction. Together, they ensure smooth and secure online booking payments, and payments overall.

A merchant account plays a significant role in managing payment activities and analytics, leading to improved approval rates and revenue growth.

Get Payment-Ready Now Don't lose bookings due to poor payment processes. Implement secure, multi-currency solutions for your travel business.

Handling Cancellations, Refunds, and Chargebacks

Managing cancellations, refunds, and chargebacks is a critical aspect of payment processing for the travel industry. To reduce the risk of chargebacks and disputes, it’s important to have clear refund policies in place. Automating the refund process can also help streamline operations and improve customer satisfaction.

Quick access and transfer of funds are essential in managing refunds and chargebacks, ensuring security and efficiency in financial transactions.

Clear refund policies and automated processes help reduce disputes and ensure a smooth customer experience. The efficient management of cancellations and refunds can enhance your business’s reputation and customer loyalty.

Security and Compliance (What You Actually Need to Know)

Security and compliance are critical in travel industry payment processing. Standards like PCI DSS, PSD2, and GDPR protect financial data and prevent fraud. These regulations are manageable with the right approach.

For example, when developing an OTA website development, payment security should be integrated from the ground up rather than added as an afterthought. Modern OTA website development emphasizes secure payment architecture that seamlessly connects to your travel APIs while maintaining robust data protection. The best OTA websites feature customized checkout flows that balance security with user experience, reducing cart abandonment while maintaining compliance standards.

Implementing robust security measures can help reduce fraud in travel payments. Protect customers’ payment information by implementing encryption, using secure payment gateways, and regularly updating security protocols. Your OTA website development should include regular security audits and penetration testing to identify vulnerabilities before they can be exploited. Adhering to these standards ensures data safety and business compliance while building trust with your travelers through visible security certifications and transparent payment processes.

Optimize Your Travel Payment Systems Today

Optimizing the Payment Experience for More Conversions

A poor checkout flow can hinder bookings. Optimizing the payment experience can boost conversions. Simple changes like reducing checkout steps and offering multiple payment methods can improve completion rates. Offering local payments is crucial for improving customer satisfaction and reducing operational complexities for online travel agencies.

Local payment methods increase customer satisfaction and loyalty. Integration with major systems ensures a seamless and efficient payment process for the travel industry. Key features such as advanced monitoring, seamless integration, and localized payment options are essential for meeting the diverse needs of online travel agencies and their customers. Focusing on customer experience drives higher sales and boosts conversions.

Streamlining Travel Payments

Streamlining travel payments is essential for travel businesses to remain competitive. By automating payment processes, travel companies can reduce manual errors, save time, and improve their overall efficiency. A single platform for managing payments can also help travel businesses to easily manage their finances, track expenses, and make informed decisions. Furthermore, streamlining travel payments can help reduce costs, improve conversion rates, and enhance the overall payment experience for customers.

Automation in payment processing allows travel businesses to handle large volumes of transactions effortlessly. This not only speeds up the payment process but also ensures that payments are processed accurately and on time. By consolidating all payment-related activities into one centralized dashboard, travel companies can gain better visibility into their financial operations, making it easier to monitor cash flow and manage expenses. Additionally, streamlined payment processes can lead to faster payments to suppliers and vendors, strengthening business relationships and ensuring smooth operations.

International Payments & Multi-Currency Handling

Managing international transactions and multi-currency payments in travel tech can be challenging. To avoid hidden fees and lost revenue, choose a payment provider that supports various payment methods and currencies. This ensures a smooth payment experience for international customers.

Multi-currency accounts offer significant benefits for managing international transactions, such as receiving payments in preferred currencies, fast transfers using local banking methods, and added security features like fraud detection and compliance frameworks.

Providers supporting multiple currencies and local alternative payment methods help cater to a global clientele, enhancing customer satisfaction and opening new markets for your business.

Best Payment Gateway for Travel Startups

For startups in the travel sector, selecting the best payment gateway tailored to their unique needs is essential. In the competitive travel payments industry, a good payment gateway for travel industry operations can make all the difference. It should offer seamless transactions, support for multiple currencies, and diverse payment methods to accommodate a global audience. Additionally, having a merchant account is crucial for facilitating transactions, managing payment data, and optimizing costs associated with incoming card and bank wire fees.

Travel APIs play a crucial role in this ecosystem, allowing businesses to connect directly with payment processors, banks, and financial institutions. These specialized travel APIs enable real-time transaction processing, automated currency conversions, and seamless integration with your existing booking systems and their specific booking engine must-have features. Unlike generic payment solutions, travel-specific APIs understand the unique requirements of the industry, such as handling deposits, installment payments, and last-minute cancellations. Using a single partner for all payment needs can streamline financial operations, reduce fees, and enhance guest experiences.

Such a gateway not only enhances customer satisfaction but also ensures efficient payment systems for travel industry startups. Additionally, integrating advanced fraud prevention measures is crucial to protect both the business and its customers. By choosing the right payment gateway, travel startups can position themselves as trustworthy and innovative players in the dynamic payments for the travel industry.

Also, always take into consideration the cybersecurity measures. Secure payments for travel platforms are crucial in maintaining customer trust and ensuring smooth transactions. When choosing a payment provider, it’s essential to prioritize cybersecurity to protect against fraudulent transactions and data breaches. Implementing advanced fraud detection and encryption measures can safeguard sensitive financial data, providing peace of mind for both the travel business and its customers. By focusing on cybersecurity, travel startups can enhance their reputation as reliable and secure, ultimately boosting customer loyalty and satisfaction.

How to Pick the Right Payment Provider for your Business?

We already established that selecting a suitable payment provider for travel is vital for your travel business. Consider factors such as fees, fraud prevention, and multi-currency support. High fees can reduce profits, so opt for a provider with competitive rates. Robust fraud prevention measures also protect your business and customers. Additionally, consider the cost-effectiveness of the payment solutions offered, as lower processing fees can enhance operational efficiency and customer satisfaction.

Popular payment services for the travel industry like Stripe, PayPal, and Adyen each have their own strengths and weaknesses. Let`s take a closer look at Stripe vs. PayPal for travel businesses situation. Stripe offers a wide range of features and supports multiple currencies, making it a great choice for international businesses. PayPal is known for its ease of use and widespread acceptance. Adyen provides advanced fraud detection and seamless integration with various systems. Efficient payment solutions are crucial for reducing costs and optimizing payment processes, leveraging advanced technology and data analytics to streamline operations and improve customer experience. To get a better grasp, here is a comparison of the most popular providers.

Top Travel Payment Providers Comparison:

| Provider | Best For | Transaction Fees | Multi-currency | Settlement Time | Special Features |

| Stripe | Overall flexibility | 2.9% + $0.30 | 135+ currencies | 2 days | Extensive developer tools, Radar fraud protection |

| PayPal | User familiarity | 3.49% + $0.49 | 25+ currencies | Instant to 3 days | Express checkout, wide consumer adoption |

| Adyen | Global operations | Custom pricing | 200+ currencies | Next day | RevenueAccelerate, travel-specific fraud tools |

| Braintree | Mobile bookings | 2.9% + $0.30 | 130+ currencies | 2-5 days | Drop-in UI, multi-currency pricing |

| Worldpay | Large-scale operations | Custom pricing | 120+ currencies | 1-3 days | Travel-specific authorization rates |

Do you want to implement secure and scalable travel payments? See our Travel Software Development Services.

Additionally, these top payment providers offer comprehensive reporting capabilities. This includes robust analytics and detailed insights into transaction behavior, enabling businesses to make informed decisions and optimize their payment strategies.

One-Stop Shop for Travel Payments

A one-stop shop for travel payments can provide travel businesses with a comprehensive solution for managing their payment processes. With a single integration, travel companies can access multiple payment methods, manage supplier payments, and track their finances in real-time. A one-stop shop for travel payments can also provide robust security, compliance, and convenience, enabling travel businesses to focus on growing their business and improving their customer experience. By partnering with a reputable payment processor, travel companies can benefit from a wide range of payment options, competitive fees, and excellent customer support.

Having a single platform for all payment needs simplifies the entire process, making it easier for travel businesses to manage their financial operations. This integrated approach ensures that all transactions are processed through a secure and compliant system, reducing the risk of fraud and data breaches. Moreover, real-time tracking of payments and expenses allows businesses to make informed decisions quickly, enhancing their ability to respond to market changes and customer demands. By offering a variety of payment options, travel companies can cater to the diverse preferences of their customers, ensuring a smooth and satisfying payment experience.

Paying Suppliers and Vendors

Paying suppliers and vendors is a critical aspect of the travel industry. Travel businesses need to ensure that they can pay their suppliers and vendors efficiently, securely, and reliably. With a comprehensive payment system, travel companies can manage their vendor payments, track their expenses, and improve their cash flow. Additionally, paying suppliers and vendors on time can help travel businesses build strong relationships with their partners, improve their reputation, and reduce the risk of disputes and fraud. By using virtual cards, bank transfers, and other payment methods, travel companies can simplify their payment processes, reduce costs, and improve their overall payment experience.

Efficient vendor payments are essential for maintaining smooth operations and ensuring that travel services are delivered without interruptions. By leveraging advanced payment solutions, travel businesses can automate vendor payments, ensuring that they are made on time and accurately. This not only helps in maintaining good relationships with suppliers but also enhances the business’s reputation as a reliable partner. Additionally, using secure payment methods such as virtual cards and bank transfers reduces the risk of fraud and ensures that sensitive financial data is protected. By streamlining vendor payments, travel businesses can focus on their core operations and drive growth.

What’s Next? Future Trends in Travel Payments

The future of travel payments in the travel industry is exciting, with several trends emerging. AI-driven fraud detection is becoming more prevalent, helping businesses protect against fraudulent transactions. The rise of buy-now-pay-later options is also changing the way customers pay for travel. Using one platform for all payment needs can significantly enhance efficiency and convenience by integrating various financial services, streamlining transactions, vendor payments, and multi-currency accounts.

Blockchain and decentralized payments are gaining attention, though their practical applications are still being explored. These trends are set to shape the future of travel payments, offering new opportunities and challenges for businesses. Future trends also aim to streamline payments, simplifying complex back-office operations and enhancing customer reach through improved payment methods.

How to Integrate a Payment Gateway into Your Travel Platform

Step 1: Define your payment needs by identifying transaction types (one-time bookings, recurring payments, deposits), currency requirements, necessary payment methods, geographic scope, and refund policy requirements. Create a prioritized feature matrix to evaluate providers against your specific needs.

Step 2: Compare and choose a payment provider by considering both technical aspects (API documentation quality, SDK availability, webhook support, testing environment) and business considerations (fraud prevention capabilities, fee structure, multi-currency support, payout schedules, and support quality). Leading options include Stripe, PayPal, Adyen, Braintree, and Worldpay, each with different strengths for travel businesses.

Step 3: Set up the integration by registering for a developer account, obtaining API keys, installing necessary dependencies, configuring your environment, implementing payment flows, creating a frontend checkout experience, handling travel-specific needs like deposit payments, and adding refund processing and multi-currency support. Ensure suppliers get paid on time by integrating flexible payment options.

Step 4: Test thoroughly before going live by running sandbox tests with various scenarios, verifying successful and failed payments, testing refund flows, checking authentication processes, and implementing robust error handling for different payment issues. Highlight the importance of integrating solutions to pay suppliers efficiently, using API integrations and virtual card numbers to streamline the process.

Step 5: Go live by replacing test API keys with production keys, updating webhook endpoints, ensuring security compliance, monitoring initial transactions carefully, having a rollback plan ready, and implementing analytics to track payment success rates and identify optimization opportunities.

Key Takeaways & Next Steps

- To start with travel industry payment solutions, follow this simple checklist:

- Evaluate your specific payment needs based on your business model

- Choose the right provider that specializes in travel payment processing

- Implement a secure and compliant integration following our step-by-step guide

- Test thoroughly with various scenarios before going live

- Monitor performance and optimize based on data

By focusing on these areas, you can gain a competitive edge and expand into new markets with confidence.

Summary

In summary, efficient payment systems for the travel industry are crucial for the success of travel businesses. By understanding the payment process, choosing the right provider, and implementing security measures, you can enhance customer satisfaction and boost conversions. Destination management companies play a vital role in enhancing customer experiences by utilizing efficient payment solutions, especially during peak holiday seasons.

The travel and hospitality sector presents unique payment challenges that require specialized solutions. Hotels need systems that handle deposits, room upgrades, and ancillary services, while tour operators must manage installment payments and group bookings. This complexity demands payment systems that understand the nuances of travel and hospitality transactions, from resort fees to seasonal pricing variations. Efficient payment systems for travel suppliers are also crucial, as they facilitate instant and secure payments, ensuring smooth transactions globally.

Optimizing checkout for travel websites is essential to enhance the user experience and drive higher conversions. By streamlining the payment process, offering multiple payment options, and ensuring seamless integration with major systems, you can significantly improve user satisfaction. Understanding the payment process, choosing the right provider, and implementing security measures are also crucial steps to enhance customer satisfaction and boost conversions.

As the travel and hospitality industry continues to evolve, staying ahead of payment trends will help you stay competitive and meet the needs of your customers. Embracing solutions that cater specifically to travel and hospitality businesses will give you the edge needed to thrive in this dynamic marketplace.

Efficient payment processing is crucial for travel businesses as it facilitates smooth transactions, minimizes the risk of lost bookings, and significantly boosts customer satisfaction. Prioritizing this aspect can lead to increased loyalty and repeat business.

When choosing a payment provider, it’s essential to consider fees, fraud prevention measures, multi-currency support, and how easily it integrates with your existing systems. These factors directly impact your operational efficiency and customer experience. Additionally, reducing chargebacks in travel payments is important. Implementing robust fraud detection systems and clear communication with customers can significantly mitigate the risk of chargebacks, ensuring smoother transactions and protecting your business from potential financial losses.

To effectively reduce the risk of chargebacks and disputes, implement clear refund policies, establish automated refund processes, and integrate robust fraud prevention measures. These strategies fortify your business against potential issues.

Future trends in travel payments will prominently feature AI-driven fraud detection, buy-now-pay-later options, and the integration of blockchain technology for decentralized payments. Adapting to these changes will enhance payment security and flexibility for travelers.

To optimize the payment experience for higher conversions, simplify the checkout process, provide multiple payment options, and ensure seamless integration with major systems. These steps will enhance user satisfaction and drive conversions.

Handling refunds efficiently in travel booking is essential for maintaining customer satisfaction and loyalty. Choosing a payment provider for travel that offers robust refund management features is crucial. The right provider will streamline the refund process, ensuring timely and accurate transactions. Key considerations include automated refund capabilities, clear communication channels, and integration with your booking system. By selecting a payment provider that excels in these areas, travel businesses can enhance their operational efficiency and improve the overall customer experience.

Questions? Answers!

Why is efficient payment processing important for travel businesses?

Efficient payment processing is crucial for travel businesses as it facilitates smooth transactions, minimizes the risk of lost bookings, and significantly boosts customer satisfaction. Prioritizing this aspect can lead to increased loyalty and repeat business.

What are the key factors to consider when choosing a payment provider?

When choosing a payment provider, it’s essential to consider fees, fraud prevention measures, multi-currency support, and how easily it integrates with your existing systems. These factors directly impact your operational efficiency and customer experience. Additionally, reducing chargebacks in travel payments is important. Implementing robust fraud detection systems and clear communication with customers can significantly mitigate the risk of chargebacks, ensuring smoother transactions and protecting your business from potential financial losses.

How can I reduce the risk of chargebacks and disputes?

To effectively reduce the risk of chargebacks and disputes, implement clear refund policies, establish automated refund processes, and integrate robust fraud prevention measures. These strategies fortify your business against potential issues.

What are some future trends in travel payments?

Future trends in travel payments will prominently feature AI-driven fraud detection, buy-now-pay-later options, and the integration of blockchain technology for decentralized payments. Adapting to these changes will enhance payment security and flexibility for travelers.

How can I optimize the payment experience for higher conversions?

To optimize the payment experience for higher conversions, simplify the checkout process, provide multiple payment options, and ensure seamless integration with major systems. These steps will enhance user satisfaction and drive conversions.

How to Handle Refunds in Travel Booking?

Handling refunds efficiently in travel booking is essential for maintaining customer satisfaction and loyalty. Choosing a payment provider for travel that offers robust refund management features is crucial. The right provider will streamline the refund process, ensuring timely and accurate transactions. Key considerations include automated refund capabilities, clear communication channels, and integration with your booking system. By selecting a payment provider that excels in these areas, travel businesses can enhance their operational efficiency and improve the overall customer experience.